Breww handles all your UK beer duty calculations for you. As long as you tell Breww everything that happens (production, sales, returns, etc), you won’t need to touch a calculator or keep manual records.

When does duty become liable?

In Breww, duty is calculated as the point the beer leaves the brewery. Whilst HMRC allows other options for calculating duty, such as on production, these are really there to make calculating the duty easier, and the most cash-flow efficient method is to calculate it when the beer leaves the brewery. While this might be the most complicated, you don’t need to worry about calculating it yourself, as Breww will do this for you. You simply need to ensure you mark your deliveries/collections as dispatched (left duty suspense) at the right time, and Breww will do all the hard work for you.

Annual production estimate & settings

In order to calculate your beer duty correctly, we need your annual production estimate. You can set this in the beer duty section and will need to update it if your estimate changes. Breww will also automatically get you to review it every year on 1st January. You can also configure your ABV calculation method - choose between Advertised, Batch measured (uses the starting and final gravity on each batch of beer), or Custom-specified.

Viewing beer duty returns

You can view your current beer duty return and all of your previous returns at any time. Your current return is always up-to-date. Breww doesn’t allow any form of editing of returns, meaning you always have a full audit log of exactly what happened (e.g. if beer left to be delivered, but came back to the brewery and was re-sold, we’ll track that all of this happened rather than “forgetting” the original sale).

Paying your beer duty

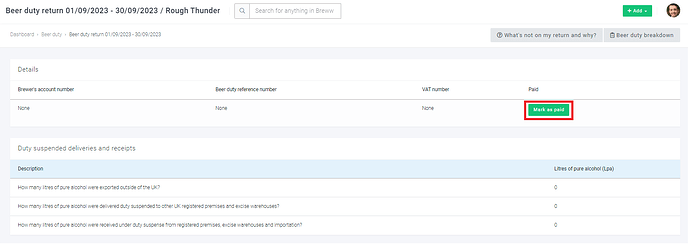

We calculate everything for you, so all you need to do is fill in the figures on the HMRC website and pay the bill. We highly recommend marking the duty return as paid in Breww at this point (but doing so in Breww is just for your own record keeping, as Breww will never submit your beer duty return to HMRC).

Marking your beer duty as paid in Breww indicates that the month’s beer duty return has been submitted and will prevent any further adjustments from being made to that return.

Notes & manual adjustments

Occasionally there may be a need to add notes or make manual adjustments to your duty return. Breww allows these to be added so you always have a permanent record of what happened, with all the information in one place - making duty inspections a delight for everyone involved! These notes and adjustments can never be removed or modified after they’ve been added (for audit purposes). If you make a mistake in a manual adjustment, just make another manual adjustment to counter the mistake. For example, if you meant to adjust the return up by £10 but mistakenly entered this as £11, you can add another adjustment for -£1. This keeps the audit-trail clean and trustworthy in case of an inspection.

To adjust your current return, you can navigate to Beer duty → Current return, scroll to the bottom of your return and click Adjustment. You will be asked when making an adjustment to add both the value and an explanation for the adjustment.

You will be able to make adjustments to a duty return up until the 15th of the next month unless the return is marked as paid before this date (as this is the HMRC deadline for submission). After this date, you will not be able to make any manual adjustments to that month’s duty return.

Beer duty breakdown

When looking at a beer duty return, there will be a button at the top right of your screen that will allow you to view your Beer duty breakdown.

The Beer duty breakdown currently lists “All payable duty entries” broken down by beer and rate payable. For this reason, it is possible to see a beer listed more than once on your return, once for each ABV and rate. This will normally result in two entries as a minimum for most beers you sell in keg or cask and in small pack format, as keg and cask will likely be under the draught relief rate, whereas small pack will not. You can read more on draught relief in our UK alcohol & beer duty updates for August 2023 guide.

You will also find entries for Duty exports, listing any dispatched to an address outside of the UK. You will also find listed entries for Duty sent to UK suspense, which will include any beer you have sent to customers that you have marked as eligible to receive beer in suspense (you can read more on this in our Additional customer options guide).

Tip: Especially on long-duty returns, finding things such as reclaims can seem a little tricky, but if you use the keyboard shortcut ctrl+F on Windows or Command+F on a Mac. you can search key terms, e.g. Reclaim, Export or Suspense, to find these on your return quickly.

It is also possible to export your beer duty by clicking the View all entries button in the top right of the Beer duty breakdown page to view all entries in a simple table. From here, you can filter the entries using BrewwQL (e.g. if you want to see only entries for a certain customer), and export the list into an Excel or CSV file.

Duty changes in August 2023

How duty is calculated in the UK on beer changed in August 2023. For more on this change, please see:

What about beer duty/taxes for breweries based outside the UK

- For breweries in the United States of America (US), Breww can help with your TTB reporting. Please see Generating TTB Brewer's Reports of Operations

- Automatic calculations for other countries are coming to Breww soon.